defer capital gains taxes indefinitely

This means that when an investor sells an investment property and use the proceeds to buy another investment property taxes are deferred until the second property is sold or if the investor dies their heirs inherit the. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

NW IR-6526 Washington DC 20224.

. It works like this. The corporate tax rate on long-term capital gains currently is the same as the tax rates applicable to a corporations ordinary income. Taxes are what we at JRW refer to as guaranteed losses and we attempt to defer or eliminate them wherever it is possible.

The net capital loss can reduce taxable capital gains included as income for the three previous tax years and indefinitely for future years. Depending on the specifics of national tax law taxpayers may be able to defer reduce or avoid capital gains taxes using the following strategies. Sales and Other Dispositions of Capital Assets or Schedule D Form 1040 Capital Gains and Losses.

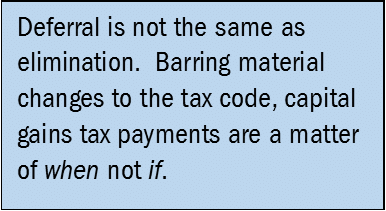

A venture capital trust is a type of publicly listed closed-end fund found in the United Kingdom. A 1031 exchange doesnt mean you never have to pay taxes on your gains. You can use 1031 exchanges indefinitely.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. Deferred Sales Trusts provide a means to defer capital gains on your appreciated property sales.

Venture Capital Trust - VCT. In this scenario the investor pays 75000 in depreciation recapture 25 of 300000 and 50000 in capital gains taxes 20 of 250000. Based on the capital gains tax brackets this gives you a 15 long-term capital gains tax rate.

For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. Capital gains taxes and. I have addressed some of the most commonly asked Q As in this new post along with a youtube video.

Defer Taxes With Incentive Programs Sometimes the government develops a special tax code to incentivize investors. When completing this part line 205 is the amount of capital losses transferred from a predecessor corporation after amalgamation or a subsidiary afterwind-up where not less than 90 of the issued shares. In the United States of America individuals and corporations pay US.

That means you can defer paying the capital gains tax on the sale of the first property. Invest Through a Self. A venture capital trust is designed as a way for individual investors.

A specific 453 Installment Sales may be used to defer capital gains taxes by breaking up payments over multiple installments. A third-party deferred sales trust will reinvest your capital while indefinitely deferring your capital gains tax obligation. You avoid FICA taxes.

While most investors are more concerned about capital gains this example shows how depreciation recapture can account for much more of an investors tax bill than capital gains. Say you buy a property for 100000 spend another 20000 on improvements and sell it for 150000 for a 30000 profit. A nation may tax at a lower rate the gains on investments in favored industries or sectors such as small business.

This means that any gains on the property upon its sale are taxed at the regular income tax rate instead of the reduced capital gains tax rate. Taxpayers may defer capital gains taxes by simply deferring the sale of the asset. Finally the word defer requires explanation too.

Applying this to the 300000 taxable portion of your gain shows that you can expect 45000 in. Taxpayers who are self-employed are normally required to pay the employer and employee portion of Social. Hi fellow Canadian Real Estate Investors.

In which case you can keep buying ever-larger and higher-yield properties and keep deferring capital gains taxes indefinitely. If an investor decides to sell the properties any taxes owed will need to be paid. That is why it is even more prudent for investors to plan strategically in their use of a 1031 exchange to defer the tax liability for depreciation recapture potentially indefinitely.

A 1031 exchange named after Section 1031 of the tax code allows property owners to defer paying taxes indefinitely by buying a similar property with their proceeds. And you can do this all while living on the rental income. By contrast individuals may be eligible for a lower rate on long-term capital gain than.

However investors can consider using a Section 1031 or like-kind exchange to defer capital gains taxes indefinitely. We welcome your comments about this publication and suggestions for future editions. The 1012 Tax Bracket.

First figure any ordinary income adjustment. Recently my clients have been asking a lot of questions about Capital gains tax and rental property. Rental property owners can conduct 1031 exchanges indefinitely to defer paying capital gains and depreciation recapture taxes.

Defer Taxes With a 1031 Exchange. There are a few. Any ATNOL arising after your 2020 tax year generally may be carried forward indefinitely.

For more information about carryover periods and special rules for 2018 through 2020 losses see Pub. But when you want to cash out your profits youll have to pay any tax owed. Read about the primary ways in which an investor can legally avoid capital gain taxesThese include the 1031 721 1033 tax-deferred real estate exchanges Deferred Sales Trust DST and various tax write-offs and credits.

Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

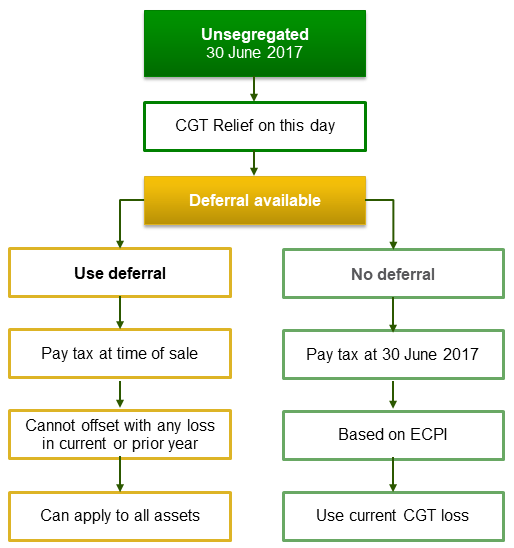

Unsegregated Capital Gains Tax Relief Reliance Auditing

High Class Problem Large Realized Capital Gains Montag Wealth

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

Income Tax Deferral Strategies For Real Estate Investors

Capital Gains Full Report Tax Policy Center

Capital Gains Tax Deferral Capital Gains Tax Exemptions

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

Deferred Sales Trust Max Cap Financial

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

Capital Gains Tax Deferral Capital Gains Tax Exemptions

.png)

What Is Cgt Deferral Relief Rlc Ventures

Capital Gains Tax Deferral Capital Gains Tax Exemptions

High Class Problem Large Realized Capital Gains Montag Wealth

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)